Key takeaways:

-

Bitcoin trades near all-time high, but derivatives data show traders remain cautious and uncommitted.

-

The USDT discount in China and spot Bitcoin ETF outflows highlight investor concerns over global trade tensions.

Bitcoin (BTC) surged above $109,000 on Wednesday after briefly retesting the $105,200 support level earlier in the day. The rally coincided with data showing monetary expansion in the eurozone and signs of weakness in the United States labor market.

Despite Bitcoin trading just 2% below its all-time high, traders remain reluctant to turn bullish, according to BTC derivatives metrics. This cautious stance has led some investors to question the rally’s sustainability.

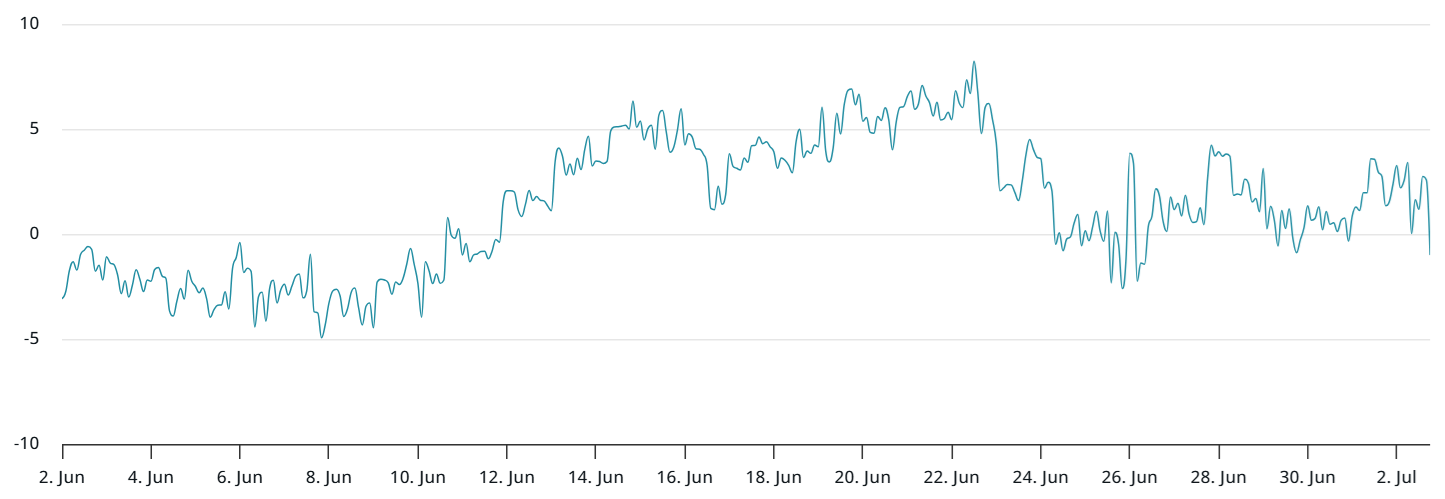

On Wednesday, the Bitcoin futures premium remained below the 5% neutral threshold. The slight increase from 4% on Monday continued a trend that began on June 11, when the indicator last approached bullish territory, coinciding with Bitcoin’s previous test of the $110,000 level.

Is the eurozone money supply increase behind Bitcoin’s rally?

Although it is difficult to identify a single catalyst for Wednesday’s rally, the eurozone’s record-high broad money supply (M2) in April likely played a significant role. The data, released Monday, showed a 2.7% year-over-year expansion, aligning with the expansionary trajectory of the US monetary base. Meanwhile, ADP data showed US private payrolls fell by 33,000 in June.

Some market participants argue that the subdued demand for leveraged long positions in Bitcoin reflects the heightened economic recession risks, particularly amid an escalating global trade war. US President Donald Trump has threatened to raise import tariffs on Japanese goods above 30% if no agreement is reached before the July 9 deadline.

Eurozone ambassadors have directed EU Trade Commissioner Maroš Šefčovič to adopt a tougher stance during his trip to Washington this week, according to the Financial Times. European capitals reportedly called for a reduction in the current 10% reciprocal tariff, although internal disagreements persist over whether to retaliate.

Neutral Bitcoin options markets and weak stablecoin demand in China

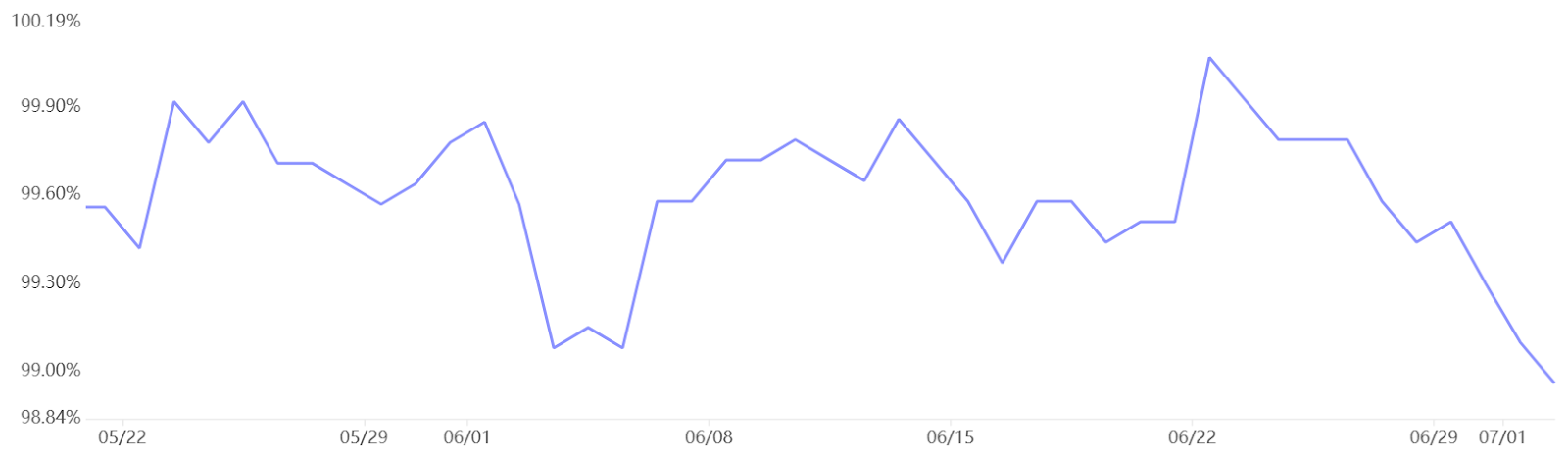

To determine whether the lack of enthusiasm in Bitcoin derivatives is limited to futures, it’s helpful to examine BTC options markets. If traders were anticipating a sharp downturn, the 25% delta skew would rise above 6%, as put (sell) options gain a premium over call (buy) options.

Currently, the skew metric stands at 0%, unchanged from two days prior, suggesting that traders see balanced risks for price moves in either direction. While this reflects lukewarm sentiment at the $109,000 level, it still marks an improvement from the bearish stance observed on June 22.

Related: Will Bitcoin benefit from ‘Big Beautiful Bill’ passage and US debt ceiling increase?

Despite Bitcoin’s price reaching a three-week high, demand for cryptocurrencies in China has declined sharply, according to the stablecoin premium.

The Tether (USDT) discount relative to the official US dollar exchange rate in China typically signals fear, as it reflects investors cashing out of crypto markets. In contrast, strong demand for cryptocurrencies tends to push stablecoins above their peg. The current 1% discount is the steepest since mid-May, indicating a lack of confidence in Bitcoin’s recent gains.

Traders have grown increasingly concerned about the fallout from the ongoing tariff war, especially following Tuesday’s $342 million in net outflows from spot Bitcoin exchange-traded funds (ETFs). As a result, the subdued activity in the derivatives market mirrors broader macroeconomic uncertainty.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.